Understanding Insurance

Frequently Used Insurance Terms:

In-Network Provider: A doctor, hospital, or other provider that has a contract with your health plan to provide services at a negotiated, lower price.

Out-of-Network Provider: A provider who does not have a contract with your plan. Visiting an out-of-network provider usually results in you paying a higher cost.

Benefits: Benefits are the health care that is covered by your health plan.

Deductible: The amount you must pay for covered services yourself before your insurance plan starts to contribute. Some preventive services may be covered before you meet your deductible. Plans are variable; it is possible to encounter individual and/or family deductibles.

Co-payment: A fixed amount you pay for a specific service, like a doctor's visit or a prescription, after which the insurance pays the rest.

Coinsurance: Your share of the costs of a covered service, calculated as a percentage. For example, if your plan pays 80%, your coinsurance is 20%.

Explanation of Benefits (EOB): A summary statement from your insurance company explaining what medical services were covered and how much you and your plan will pay. This is not a bill.

Out-of-Pocket Costs: What you pay for care that isn’t covered by your health plan.

Out of Pocket Maximum (or out of pocket limit): An out-of-pocket maximum is the most you need to pay for you or your family’s care in a year before your health plan pays 100% of it. Your health plan will then pay up to the allowed amount.

Prior Authorization: Prior authorization is an approval you may need to get before getting certain health care services, treatments, prescription drugs or health equipment. Without this approval, they may not be covered by your health plan.

Billing Codes (Current Procedural Terminology, CPT): Designated by the U.S. Department of Health and Human Services under the Health Insurance Portability and Accountability Act (HIPAA) as a national coding set for physician and other health care professional services and procedures, CPT’s evidence-based codes accurately encompass the full range of health care services.

Superbill: A Superbill is a detailed invoice or receipt for health services that you (the patient) receive from an out-of-network provider. You can then submit this document to your insurance company to request direct reimbursement for the services paid. It contains all the necessary codes and information (like diagnosis and procedure codes) your insurer needs to process your claim.

Dr. Kane is In-Network: Making Assessment Services Accessible

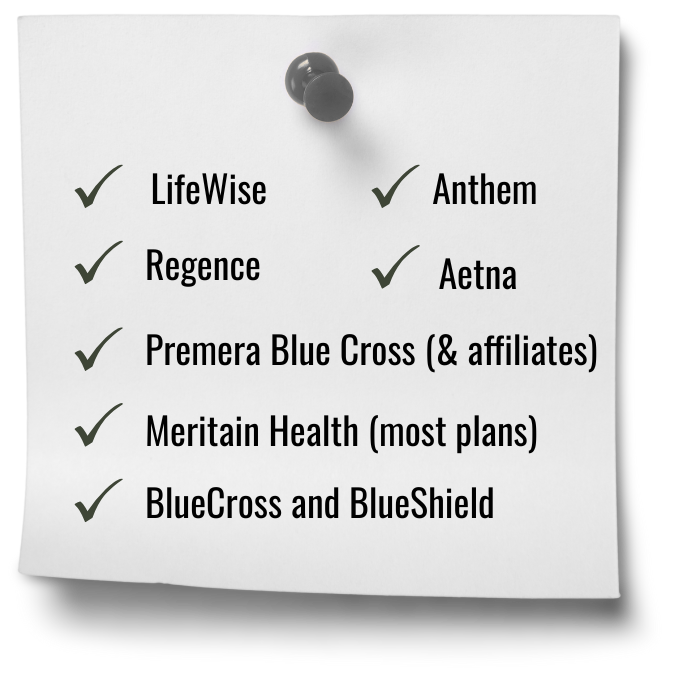

Dr. Kane will submit billing directly to the following in-network insurance companies: LifeWise, Regence, Anthem, Aetna, Premera Blue Cross (& affiliates), Meritain Health (most plans), and BlueCross and BlueShield. Due to the variability of insurance plan coverage, deductibles, copays, excluded benefits, etc., Dr. Kane is unable to provide an estimate of out-of-pocket costs. It is the client’s responsibility to communicate directly with their insurance company concerning the following: Behavioral health benefits, coverage of neuropsychological assessments, insurance plan deductible, and if Dr. Kane is listed as an in-network provider. Billing codes are available by request. For out-of-network insurance, a superbill can be provided upon request.

Support is Available

If you would like support or have additional questions, please do not hesitate to email admin@drsamuelkane.com for further assistance. Billing codes are available upon request.

Some helpful questions to ask your insurance company include:

I am seeking a comprehensive neuropsychological evaluation/assessment;

Does my insurance provide coverage for a neuropsychological evaluation/assessment?

Is Dr. Samuel Kane listed as an in-network provider?

Have I met my family and/or individual deductible?